After experiencing multiple bull and bear market cycles, the crypto market is gradually moving away from a single narrative centered on price fluctuations. Whether it’s the Bitcoin halving, the approval of ETFs, or the rapid rotation of trending sectors, all these events reinforce a reality: while market movements can occur repeatedly, a growth model solely driven by price and sentiment is increasingly unable to support the long-term consistency of the system.

This shift is particularly evident in the decentralized finance (DeFi) sector. In the past few years, DeFi competition has largely revolved around liquidity scale, incentive efficiency, and governance mechanisms, with numerous protocols vying for users and funds through high subsidies and rapid iterations. However, after several periods of sharp market volatility, issues such as liquidity withdrawal, parameter failures, and emotional sell-offs have repeatedly emerged, prompting the market to re-examine a more fundamental question: how are prices actually formed, and does the system possess the structural capability to withstand emotional shocks ?

Against this backdrop, discussions surrounding whether “rules can become a new source of certainty” have gradually intensified , and PMM (Perpetual Motion Machine) has thus gradually come into the view of more industry participants.

Market participants are starting to focus on rule-based DeFi structures.

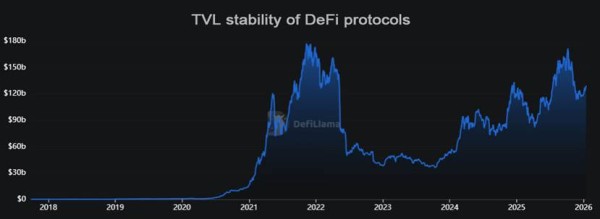

According to DeFiLlama’s TVL data, protocols that have shown greater stability in terms of fund retention and volatility in recent years often possess a clear and non-frequently adjustable rule structure. These systems typically reduce their reliance on short-term incentives and human intervention through fixed supply and execution logic, thereby exhibiting greater consistency and sustainability across different market phases.

Unlike previous projects that relied on grand narratives or short-term gains to attract attention, PMM did not enter the mainstream through large-scale marketing in its early stages. Instead, it gradually spread within research communities and groups discussing its mechanisms. The focus repeatedly mentioned was not on any particular price performance, but rather on its institutional handling of price operations.

In various on-chain research communities and mechanism analysis discussions, PMM is often used as a case study to explore a core question: does price necessarily need to be formed through continuous game theory ? Some long-term participants believe that, given the current highly homogenized DeFi structures and similar parameter models, rule-based systems may be becoming a new direction for exploration.

In terms of participant structure, PMM’s followers are mostly from groups with clear demands for system stability, structural security, and long-term consistency. These participants typically focus more on whether the rules are clear, whether the execution is irreversible, and whether the system has a logical foundation for long-term operation, rather than short-term fluctuations.

This composition of participants also makes PMM’s dissemination path present a different rhythm from traditional DeFi projects: the discussion focuses more on the institutional and structural layers, rather than the market conditions and price fluctuations.

Institutional design has made PMM a model for discussion.

Beyond community attention, PMM’s own institutional design is also a key reason for its inclusion in industry discussions. Unlike most DeFi protocols that respond to market changes through governance voting or parameter adjustments, PMM’s design philosophy leans more towards “ex-ante constraints,” that is, using irreversible rules to predetermine the price path.

Its core mechanism revolves around minting its native token, SKY . The system requires that the liquidity pool and market circulation always maintain a 1:1 correspondence, and SKY is only generated when real funds enter the system. This structure eliminates common risks such as pre-issuance and oversupply at the institutional level, ensuring that the supply of SKY is highly synchronized with the flow of funds.

At the transaction layer, PMM’s handling of selling behavior also differs significantly from mainstream AMM mechanisms. Selling no longer enters the traditional price acceptance process, but instead triggers the contract execution logic of SKY burning and fund repatriation. Therefore, trading behavior is no longer used for price speculation, but is integrated into the system’s operation itself, becoming part of the continuous advancement of the structure.

From an institutional perspective, this type of design does not attempt to “predict the market,” but rather reduces the system’s reliance on emotional feedback through rules, making price evolution more subject to structural outcomes rather than short-term behavioral shocks.

The market is giving rise to a new DeFi narrative.

From a broader perspective, the emergence of PMM coincides with a shift in the DeFi narrative. As market patience wanes for high-volatility, high-gambling models, rule certainty and structural stability are becoming the new focus of attention.

In this process, PMM does not represent a specific strategy, but rather a shift in design paradigms: whether prices can no longer rely on short-term behavioral feedback, but rather on continuous institutional execution. Its proposed “unilateral upward” logic is also understood more as a description of structural outcomes than a promise regarding market trends.

The market is evolving and the landscape is changing, but current trends suggest that issues surrounding price rules themselves are gradually becoming a new public topic in the DeFi field and are beginning to influence the underlying design principles of projects.

PMM is pioneering the validation of a viable path for “rule-based DeFi”.

PMM is currently at the forefront of exploring rule-based DeFi structures. Its NFT and node system is not designed for short-term fundraising or amplifying market sentiment, but is explicitly embedded within the institutional framework as a crucial component of SKY minting , distribution, and structural coordination. This design path, prioritizing rules over expansion, allowed PMM to maintain a restrained pace in its early stages, enabling its institutional integrity to be implemented before its scale.

In the current DeFi market environment, which still largely relies on game theory and incentive-driven mechanisms, PMM is the first to attempt to incorporate price movement direction, supply contraction, and value accumulation into irreversible rules. In fact, it has become a cutting-edge practice of rule-based systems. Its significance lies not in its short-term performance, but in providing a workable, real-world example for the proposition of “whether prices can evolve continuously without emotional feedback.”

As the system continues to operate and on-chain data accumulates, PMM’s institutional logic is transitioning from design assumptions to practical verification. If its structure can maintain stable execution over a longer period, PMM is expected to further solidify its exemplary position in the rule-based DeFi path and provide the industry with a long-term reference point different from traditional game theory models.

PMM may guide the next phase of institutional narratives.

As the market gradually realizes that incentives and competition alone cannot sustain long-term consistency, the focus is shifting to more fundamental issues—whether prices and values can be consistently constrained by the system. More and more participants are beginning to realize that what truly determines the lifespan of a system is not short-term activity, but whether the rules possess long-term self-consistency.

The Producer Model (PMM) presents a design approach that pre-establishes price movement direction, supply changes, and value accumulation within the system. This approach does not rely on continuously introducing new variables, nor does it emphasize flexible adjustments; instead, it drives the system’s natural evolution through fixed logic. When the system itself can be consistently implemented, price outcomes no longer require frequent interpretation.

If this type of design proves effective over a longer period, the market’s focus may shift—from “whether it can run faster” to “whether it can run longer.” PMM is currently close to the starting point of this shift, and its subsequent performance may become an important reference for judging whether this direction is viable.

Conclusion

As the market gradually shifts from chasing price increases to understanding structure, the competition in DeFi is also shifting from “who is faster” to “who is more stable.” In this process, rule-based systems like PMM may not provide answers in the short term, but their exploration itself has become an indispensable part of this stage.

City: Colorado, USA

Company: Animara Global Inc

website https://animora.one

Contact: Animara

Email: 9192318@gmail.com